Gas, food and cars got more expensive whereas, tuition fees and phone bills got cheaper.

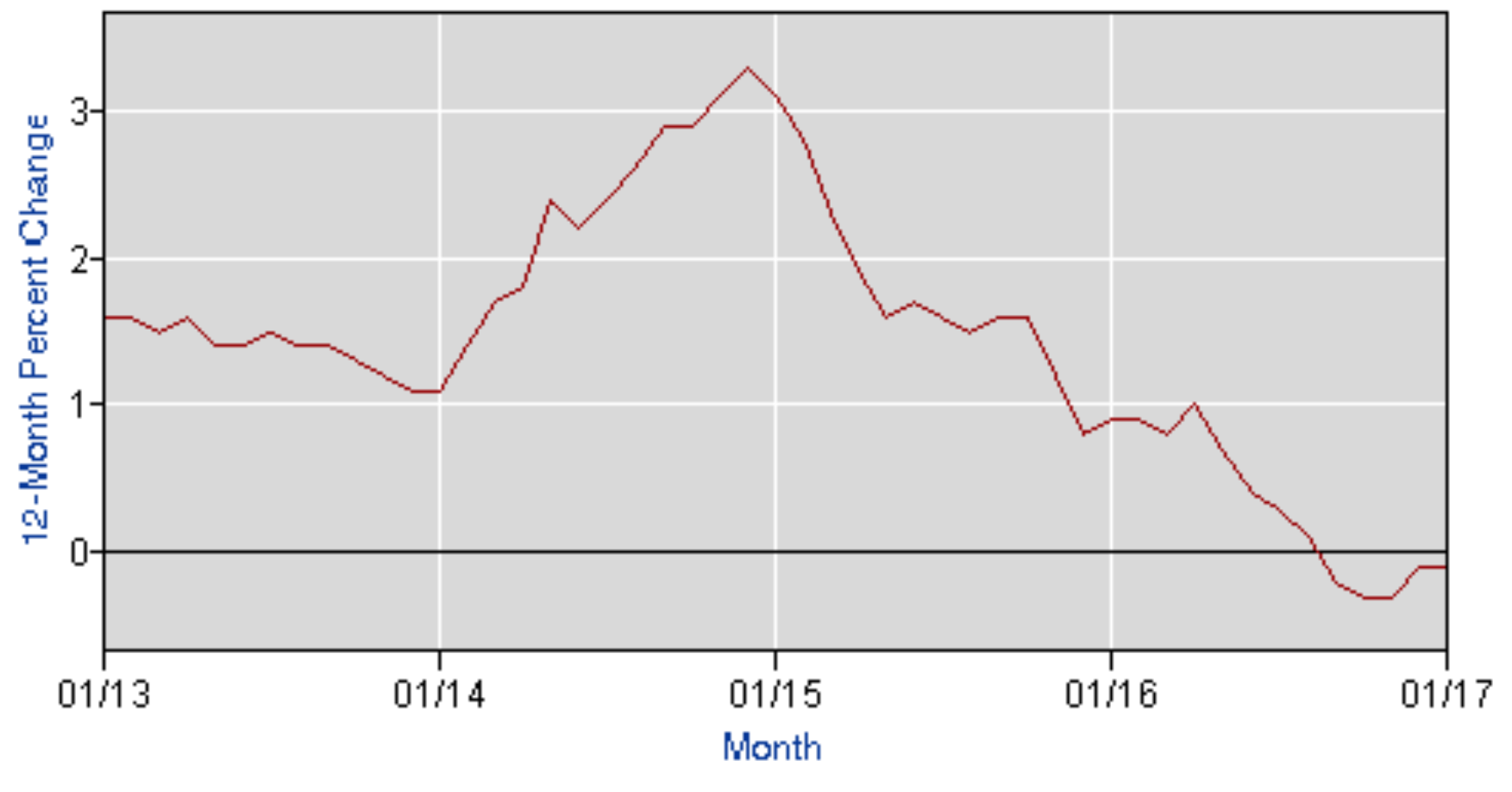

The price of living went up by 2.4 per cent in January from a year earlier, a slight uptick from December’s level.

Higher gasoline prices were a major factor in the uptick. Pump prices were 11 per cent higher in January than they were a year earlier, a month during which a global supply glut pushed them down at the time.

TD economist James Marple noted that the reintroduction of a carbon tax in Alberta in January was a factor in the gas price surge. But he does not expect it to last.

“While oil and gasoline prices rose at the start of January, they plummeted through the month as news around the COVID–19 outbreak spread,” Marple said, noting that oil prices are down 12 percent on average so far in February from January’s level.

If the impact of gasoline is stripped out of the numbers then Canada’s yearly inflation rate would have been two per cent for the month. The 2.4 per cent inflation rate is an increase of 0.2 percentage points from December’s level.

Another factor- Food

The high prices for fresh vegetables were also a factor in the higher inflation figure. Tomatoes got 10.8 percent more expensive in the past year, more than twice the five percent increase seen in other types of fresh vegetables

“The higher prices stem from inclement weather in growing regions in the United States and Mexico,” the data agency said.

Clothing prices were also an unexpected source of strength in the numbers. The price of new clothes increased by 3.9 per cent in the year up to January — the highest yearly figure since 1991.

“Just to give a sense of how unusually strong that is, this category has averaged a yearly price decrease of 0.8 percent over the past 20 years,” BMO economist Doug Porter noted.

Overall, the inflation rate increased everywhere but Quebec and Ontario, where it stayed flat.